As awareness escalates around climate change, institutional investors are leaning toward more sustainable investing.

Why? Investors believe sustainability creates tangible value for shareholders because such investments do not harm people or the planet. Investors also can feel as if they can have an environmental or social impact by investing to make the world a better place. Because of increasing investment opportunities, money managers and intuitional investors are becoming better engaged to invest in companies based on their sustainability performance.

Long a trend in Europe, more U.S. companies now are looking at sustainable investing. In fact, the ESG Advisory Program states that in global ESG about $31 trillion assets are under management, which is a 34% increase since 2016. That year, 75% of investment community respondents stated that they saw “improved revenue performance from sustainability as a strong reason to invest,” according to findings from “Investment for a Sustainable Future”, a research project by MIT Sloan Management Review. In that same report, more than 60% of respondents believe that solid sustainability performance reduces a company’s risks.

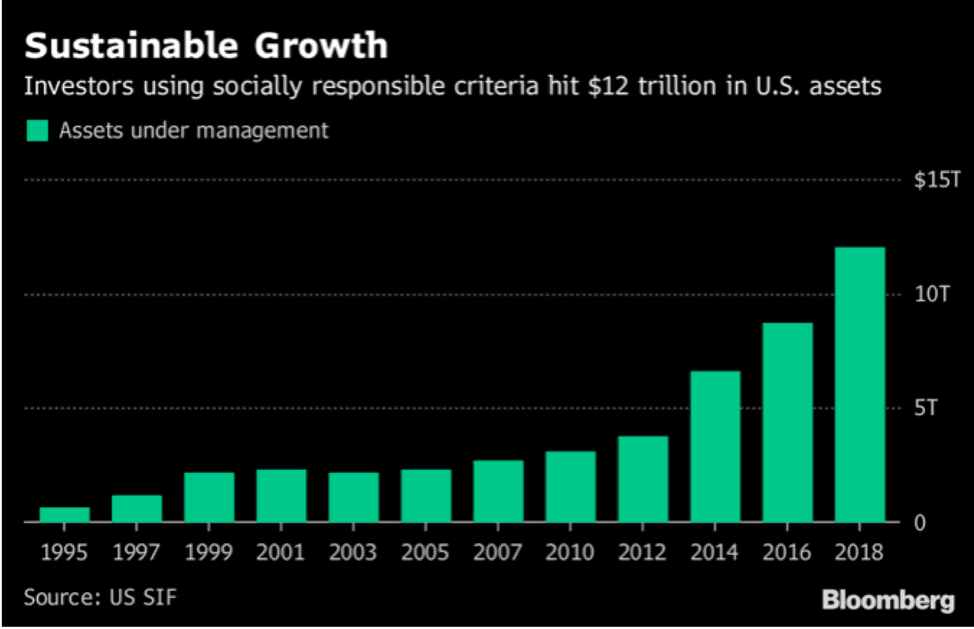

The Forum for Sustainable and Responsible Investment (US SIF) reports that in just a two-year period, from 2016 to 2018, sustainable, responsible and impact (SRI) investing increased more than 38 percent, increasing from $8.7 trillion in 2016 to $12 trillion in total assets under management at the end of 2017. Assets managed with sustainable investing strategies now represent 26 percent of all investment assets under professional management in the United States, according to the 2018 Global Sustainable Investment Review.

Graph source: https://www.investmentnews.com

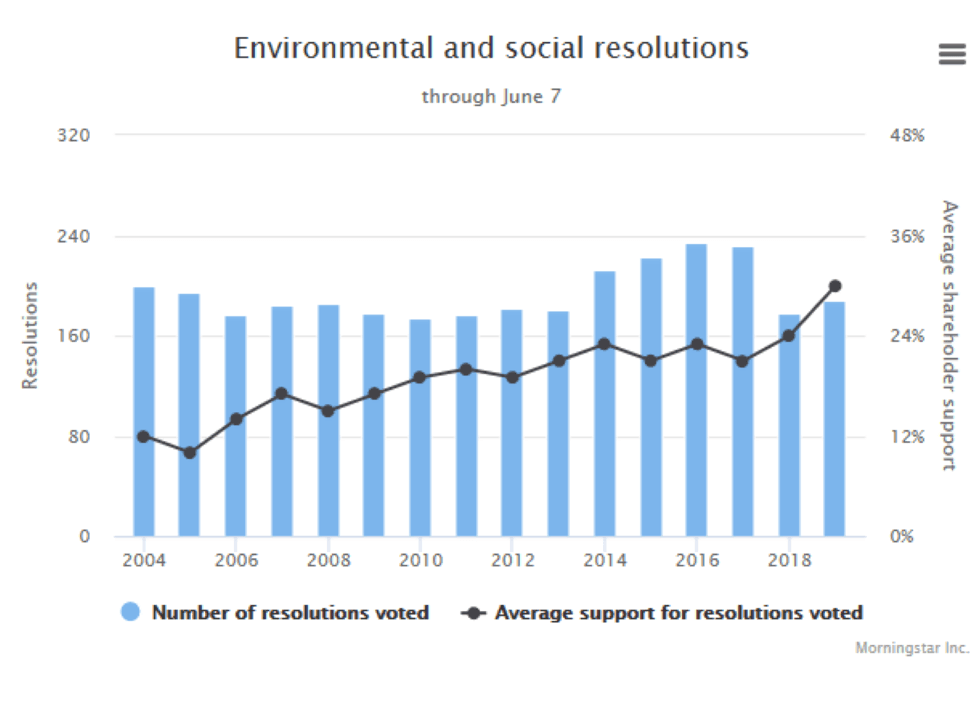

The interest in sustainable investment will only continue to grow over the next decade. Shareholder resolutions prove that. In 2019, environmental and social shareholder resolutions have gained on average 30% more support than in 2018. Pension & Investments state that’s an increase of 6% from last year and its highest reading in the past 16 years.

Some examples of such investments by shareholder resolutions include responsible property funds that help to develop or retrofit residential and commercial buildings to be more environmentally friendly with high energy efficiency standards and public pension plan officials investing in companies while encouraging then to factor climate change into their businesses.

Investors make an impact. “From 2016 through the first half of 2018, more than 200 institutional investors and money managers collectively controlling a total of at least $1.76 trillion in assets filed or co-filed shareholder resolutions on ESG issues,” according to US SIF. Investors can put pressure on companies to be more environmental friendly, and, therefore, influence company policy.

Graph source: https://www.pionline.com

As this trend continues, investors are prepared to divest from companies that have subpar sustainability performance.

A recent report by Harvard Business Review interviewed 70 senior executives at 43 global institutional investing firms and found that ESG is a top concern for them as more of their clients seek investments that can make a positive impact on the world.

While some investors may be timid to divest in companies that do not engage in ESG practices, many are not. Approximately 60 percent of investment firms’ board members are willing to divest from companies with a poor sustainability footprint. Nearly half of investors say they will not invest in a company with a record of poor sustainability performance, according to an article in “The Bridge to Better Brands.”

While sustainable investing has been growing in the 21st century, it has accelerated. Why the sudden shift to environmentally-friendly investing? Investors cite several reasons including shareholder value and strong financial performance. But another driving force may be the new face of America’s workforce: Millennials, an influencer demographic that is savvy with expectations for sustainability to be a new way of life in the 21st century, and that includes smart investments in ESG.

Engaging institutional investors around sustainability performance is an area where Round Rock can collaborate with organizations to create tangible value. If this is an area where your organization’s awareness could benefit, send an inquiry to us at